LA R-1367 2007 free printable template

Show details

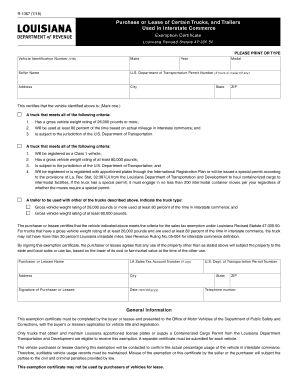

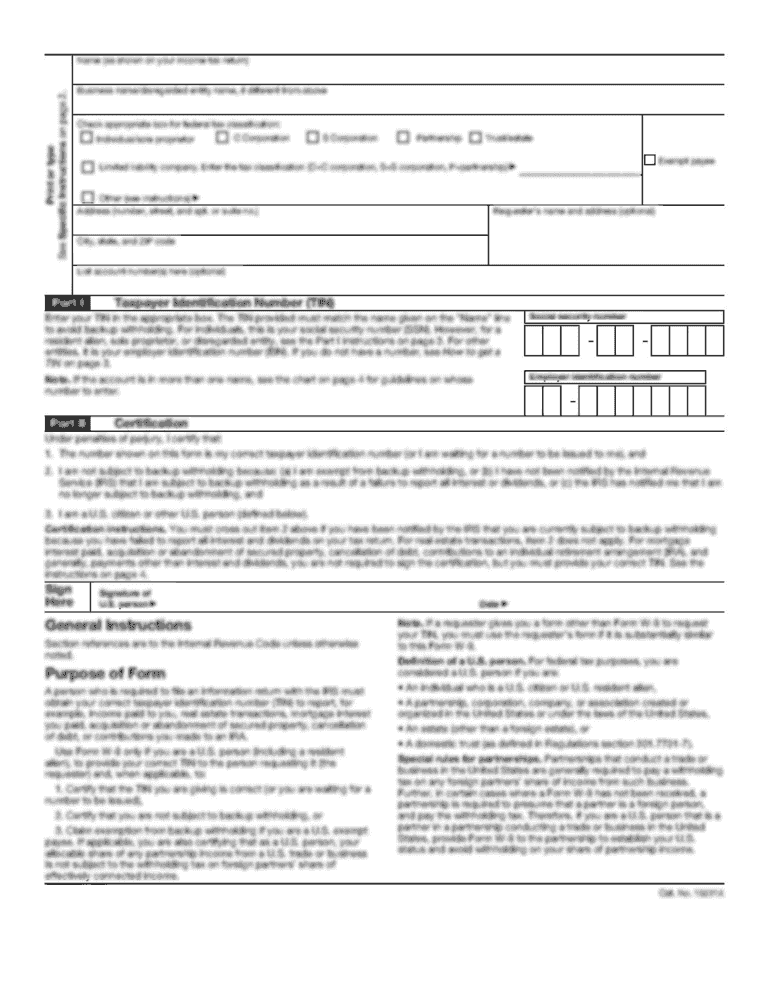

R-1367 8/07 Exemption Certificate for Purchase or Lease of Certain Trucks Trailers and Buses Used in Interstate Commerce Revised Statute 47 305.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA R-1367

Edit your LA R-1367 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA R-1367 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA R-1367 online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit LA R-1367. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-1367 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA R-1367

How to fill out LA R-1367

01

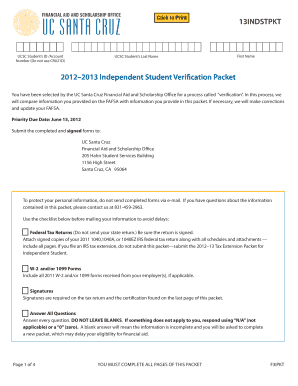

Obtain the LA R-1367 form from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Enter your personal information in the designated fields, including name, address, and contact information.

04

Fill out the specific details required for each section, ensuring accuracy and completeness.

05

Review the form to double-check for any errors or missing information.

06

Sign and date the form at the bottom as required.

07

Submit the completed form to the appropriate office, either by mail or in person.

Who needs LA R-1367?

01

Individuals applying for certain permits or licenses related to their business or personal requirements.

02

Any entity required to report specific information to the local authority as mandated by law.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a Louisiana tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

How do I apply for exemption from collection of Louisiana state sales tax?

You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

What is the tax exemption form for farmers in Louisiana?

Farmer Certification The purchaser must complete the R-1060 and attach a copy of their LDR-approved R-1085 (Farmer or Agricultural Facility Certification) to be exempted from state sales tax on the first $50,000 of the sales price of the items listed below.

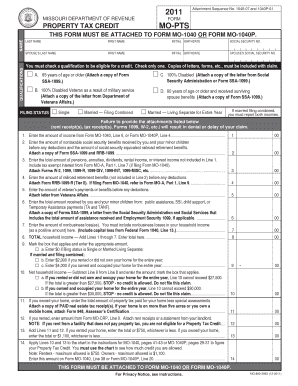

How is Louisiana state income tax calculated?

Like the federal income tax, the Louisiana state income tax is based on income brackets, with marginal rates increasing as incomes increase. In total, there are three income brackets.Income Tax Brackets. Single FilersLouisiana Taxable IncomeRate$0 - $12,5001.85%$12,500 - $50,0003.50%$50,000+4.25% Jan 1, 2023

Where can I get Louisiana state tax forms?

The Louisiana Department of Revenue, opens a new window (LDR) provides free digital copies, opens a new window of tax forms. You can also get tax forms mailed to you at no cost by ordering forms online, opens a new window or calling the LDR at 888.829. 3071 and selecting option 6.

How to fill out Louisiana state tax form?

0:13 2:17 Form IT 540 Individual Income Return Resident - YouTube YouTube Start of suggested clip End of suggested clip Step 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on lineMoreStep 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on line 8b. Then subtract the ladder from the former enter the difference on line 8c.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my LA R-1367 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your LA R-1367 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I modify LA R-1367 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including LA R-1367. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the LA R-1367 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign LA R-1367 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is LA R-1367?

LA R-1367 is a form used by the Louisiana Department of Revenue for reporting various tax-related information.

Who is required to file LA R-1367?

Businesses and individuals who have specific tax obligations in Louisiana are required to file LA R-1367.

How to fill out LA R-1367?

To fill out LA R-1367, gather the necessary financial information, complete each section as required, and submit the form to the Louisiana Department of Revenue by the specified deadline.

What is the purpose of LA R-1367?

The purpose of LA R-1367 is to ensure accurate reporting of taxable transactions and to help the state collect the appropriate taxes.

What information must be reported on LA R-1367?

LA R-1367 must report details such as income, deductions, and specific tax credits related to Louisiana tax law.

Fill out your LA R-1367 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA R-1367 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.